does idaho tax pensions and social security

52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. Exceptions include Canadian Social Security benefits OAS QPP and.

Social Security Who Is Receiving Checks For Up To 1 657 Today Marca

Part 1 Age Disability and Filing status.

. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old. For example Iowa allows joint filers 55 and older to. Does Idaho tax pension benefits.

However the state inheritance tax may be a negative for some seniors. As they work teachers and their employers must contribute into the plan. As is mentioned in the prior section it does not tax Social Security income.

How Much Does Idahos Teacher Pension Plan Cost. 800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans. While potentially taxable on your federal return these arent taxable in Idaho.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. We have guides to help you learn more about Idaho Residency Status and Idaho Source Income. The remaining three Illinois Mississippi.

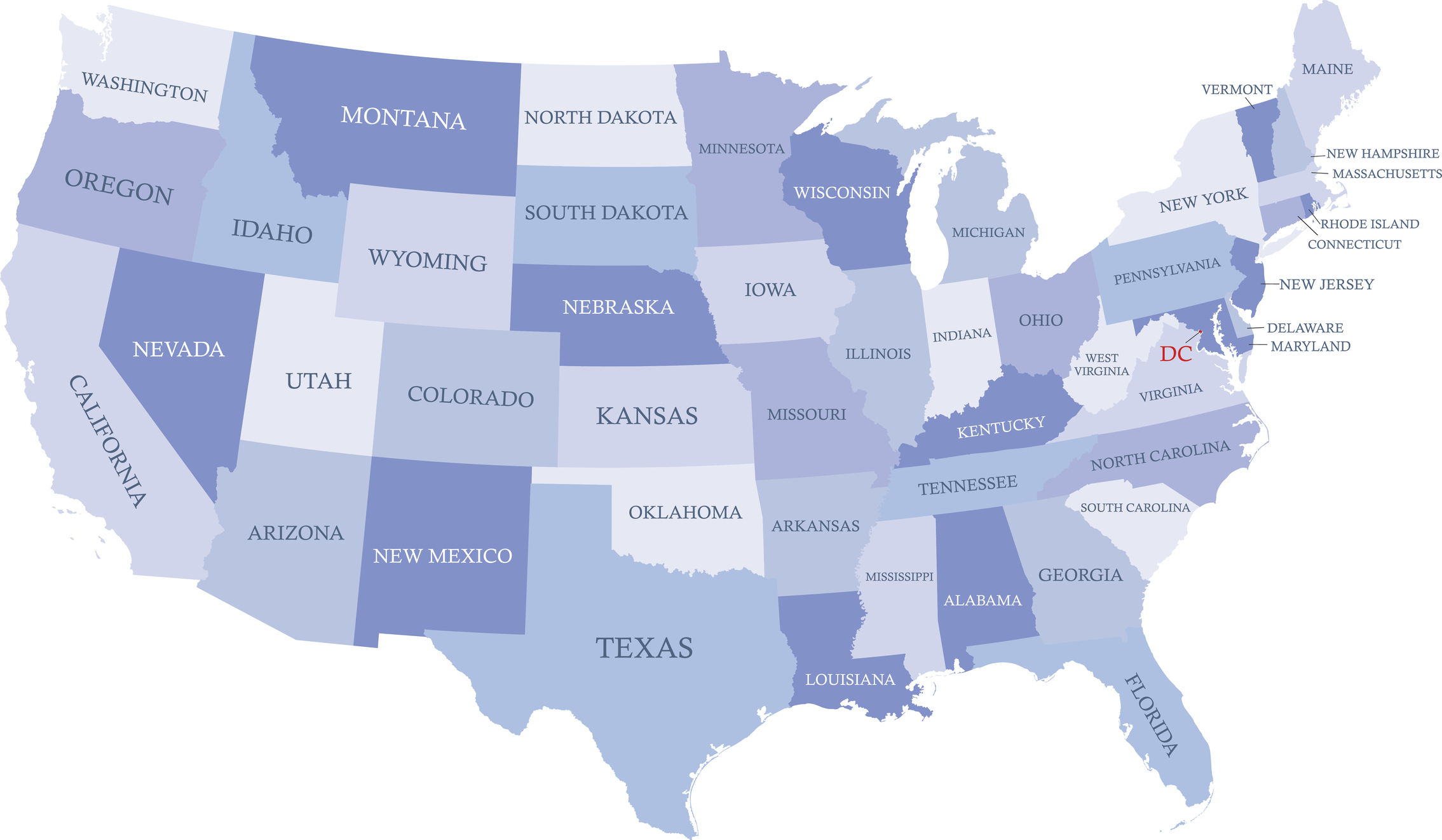

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Here are the 37 states that do not tax your Social Security benefits. According to Wolters Kluwer a tax publishing company 27 states tax some but not all of retirement or pension income.

Minnesota partially taxes Social Security benefits. The 3 rate will be phased out by 2022 with potential plans to eliminate the income tax entirely by 2030. Those contribution rates are set by the state legislature and can change year-to-year.

You also dont have to pay taxes on your Social Security benefits. The rule is subject to phaseouts starting at incomes of 80270 for joint married filers. Does Idaho tax Social Security benefits.

When you retire PERSI will pay you every month for as long as. The state allows a subtraction from benefits ranging from 2645 for married taxpayers who file separately to 4130 for single taxpayers to 5290 for married taxpayers who file jointly. Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits.

The following states are exempt from income taxes on Social Security Benefits. The actual value of your benefit exceeds your contributions and interest. Mississippis rates range from 3 on 3001 to 5000 4 on 5001 to 10000 and 5 on more than 10000 of taxable income.

Social Security benefits are not taxed for disability recipients who have a federal AGI of less than 85000 100000 for married couples. A lack of tax. In 2018 teachers contributed 704 percent of their salary to the pension fund while the state contributed 1199 percent.

Aker solutions structural engineer. Individual taxpayers are exempt from paying state taxes on their Social Security benefits if their federal AGI is less than 44460. Where Social Security is taxed.

Minnesota 33 of Benefits Missouri Based on Annual Income Amount Montana. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all. Yes Kentucky is fairly tax-friendly for retirees.

800-972-7660 or taxidahogov Retirement Benefits exclusion. The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks in at a relatively low. Below is a screenshot that shows you how the formula works.

The Base Plan is a qualified tax-deferred plan under IRS Code Section 401 a. PERSI provides retirees with a stable lifetime monthly income to supplement their Social Security benefits and personal savings. Does idaho tax social.

Other forms of retirement income pension income 401k or IRA income are exempt up to a total of 31110 per person. Typically these states tax pension income only above a certain level of adjusted gross income. Connecticut 50 of Benefits Florida no state taxes Kansas.

Object Moved This document may be found here. Married taxpayers who file jointly are exempt from paying. Most pension benefits are currently taxable on your Idaho state income tax return.

If you dont live in those 14 states you still may avoid paying taxes on all or some of your pension. Lets start with the bad news first. Here are the 12 states that tax Social Security benefits.

Watchdog Reports Reveal Problems At The Strained Underfunded Social Security Administration Pbs Newshour

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

States That Don T Tax Retirement Income Personal Capital

Taxability Of Social Security Benefits

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Proposed Legislation Would Expand Social Security Repeal Gpo And Wep

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

Which States Don T Tax Social Security Benefits

How Much Is The Average Social Security Benefit In Every State Simplywise

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

At What Age Is Social Security No Longer Taxed In The Us As Usa

Is Social Security Income Taxable

Are There Taxes On Social Security For Seniors Aginginplace Org

Common Law Marriage And Social Security

37 States That Don T Tax Social Security Benefits The Motley Fool

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Social Security Checks May See A Huge Raise Next Year Will It Be Enough

13 States That Tax Social Security Income The Motley Fool

37 States That Don T Tax Social Security Benefits The Motley Fool

All The States That Don T Tax Social Security Gobankingrates